Something’s Missing from Your Gain: Why Publishers Need Floor Price Optimisation

Nothing is ever perfect, and neither is RTB, which both advertisers and publishers once deemed a promising cure-all. From technical implementation to legal compliance, there are many challenges. Take header bidders for instance – having won a bid or not, they can still install tracking pixel into the page and tap website traffic without the publisher knowing. For the publisher, this is a loss of profit, as well as a risk of user data leakage.

However, abandoning the RTB is not an option. Instead, let us analyze what stands between the publisher and their profit and how to overcome it.

Chalk and Cheese Auctions

RTB sales run through first- and second-price auctions. The publisher can influence both through floor price.

At a first-price auction, the winner pays what he has bet. As buyers strive to minimise spending, in the long run, bids go down. Floor price helps the publisher to manage fill-rate and keep inventory prices fair yet affordable for buyers.

Having won the second-price auction, the advertiser will pay less than what they bid anyway, so there is no reason for them to over- or undervalue impression. The goal is to outrun rivals without overpaying. As a result, bids correspond to the true value of the inventory, and buyers do not dump prices, which is the preferable outcome for the publisher as well.

As for the floor price, the website’s objective is to keep it as close to the highest bid as possible, so it becomes the second price.

Where the Money Goes

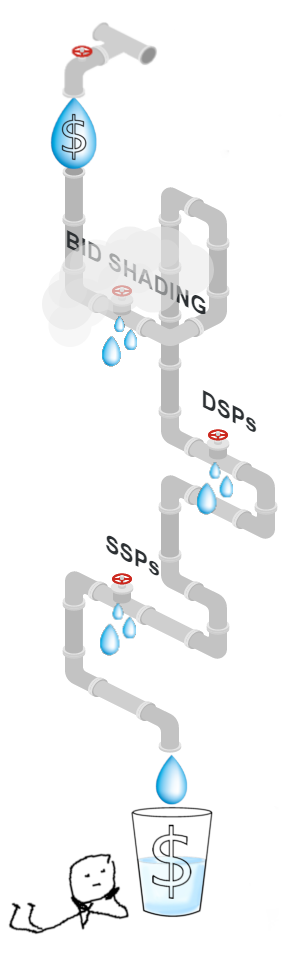

Between the publisher and advertisers, there is an X number of intermediaries who shoulder transaction costs. They collect data on the ad inventory, the user, etc. and conduct the auction itself. For their service, they receive a fixed percentage from both seller and buying sides.

The simplest of the unpleasant things that ad exchange and SSP can do is to conceal the real fee charged from the buyer as neither publishers nor advertisers have full information about bids. Reports delivered to the publisher provide average statistics collected after all the intermediate costs have already been subtracted. So one cannot find out the actual price of the inventory straight away. In this regard, the Guardian and the Rubicon Project case is a very prime example. To find out what drains revenue away, the Guardian started buying its own ad inventory systematically and compared the ins and outs of it. The difference did not coincide with the contract terms. Up to 70% of the money paid by the Guardian to themselves was scattered among the vendors.

Another trick is concealing the auction type. RTB is associated with a second price auction. When ad exchangers hold the first-price auction with stealth, advertisers pay much more than they planned. But you will never know.

DSP can also tell the advertiser that ad exchange conducts the first-price auction when it does not. That way, the margin between the first and the second prices ends up in someone else’s pocket, again.

Even at the second-price auction, dishonest SSPs can still capture the first bid. In 2017, OpenX with an unnamed DSP compared sales data and found out that some SSPs set the clearing price at over 95% of the first-price bid a millisecond before the deal is closed.

The “light option” is manipulation not with the auction type, but with clearing price. For example, adding the arithmetic mean of the two highest bids to the second price instead of 1 cent.

One can only guess how much money spent by advertisers had not reached publishers. Apart from evident revenue loss, publishers lose strategic advantages, as they receive inadequate information about the inventory value. And this impedes long-term development.

What Do You Do?

Of course, the ambition is to achieve transparency throughout the entire ecosystem, from the auction rules to the reports. Only in this case can you avoid deceit. But regardless of whether the auction is being held honestly, or everyone withholds something, the publisher has a trump card – price floor.

Inventory prices vary per day substantially, and due to demand elasticity, you can significantly increase profits. As a bonus, floor price optimization works against bid shading algorithms that help advertisers adapt bids when they move to the first-price auction.

What do you need to play your trump card successfully?

- Bids historical data give an understanding of inventory value and its typical patterns. Such information is difficult to obtain, since not so many DSPs and SSPs are ready to share complete statistics.

- Traffic mediation: you can start by segmenting inventory and setting floor prices for each segment separately.

- Soft-floor and hard-floor combination: soft-floor also acts as the second price, thus helping to fill an impression if none of the bids has exceeded the hard-floor price and to save profit if the maximum bid is much higher.

- Accurate forecasting: to get the maximum revenue, it is useful to know the volume of available traffic and the ad campaign delivery dynamics in figures and at a certain time. And also to predict who will buy what amount of inventory and for what price.

- Automation: in manual mode, it is easy to miscalculate floor price and lose impressions or overlook a significant increase in bids. Algorithms monitor sales 24/7.

What Is Already In Place? Google and Yandex, in fact, work with a static floor price.

Yandex Advertising Network partners set CPM thresholds for selected RTB blocks with configured targeting parameters. In Adfox, price floor can be changed manually and set separately for a specific brand. Together with sales dynamics, it affects the priority of the campaign, and therefore, delivery pacing and profit.

Dynamic monetization 2.0 gives the user more leeway. At the 11th priority, for Google as an external monetizer, you can set a pack of CPM thresholds from which the robot will choose the better one. The server takes into account internal adjustment factors, including visibility and Google AdX bids predictor.

In Google Ads an auction result depends on the advertiser’s Ad Rank which is based on Max CPC bid and Quality Score. The latter may even outweigh another customer’s bid. Google Ad Manager switches to first-price auction next year, till then advertisers can use Bid Shading for free.

There are dedicated tools as well. For example, clickio offers automated traffic mediation and floor price setup for mobile ads. Advelvet and Roxot offer their help to Google Ad Manager customers. Companies such as Adomik, Maxifier, and MonetizeMore also optimise CPM. Inventale helps adjust floor price in real-time based on traffic and sales plans forecasts.

To Summarize

Monetizing content is easier than ever. To make the most of it is much more difficult. Although RTB was intended as a way to sell ads conveniently, quickly and efficiently, in practice, it still requires reinforcement. Fortunately, there are several ways for the publisher to give two cents and make a fortune, and the payoff of each of them varies significantly.

Even close attention to sales and regular floor price adjustments have a positive effect on the income. However, manual management of the RTB processes is very challenging, and no one will deny that algorithms run automated transactions way better. So it is very opportune that more and more tools that can help increase revenue not just from inventory segments, but from a single impression, are emerging onto the market.

Whether to rely on their experience and intuition, build automated tools in-house, or outsource is up to the publisher.